As a broker, we have seen a continuous rise of enquiries about Liability Insurance in China recently, with an especially high attention on Professional Indemnity. This article is a brief discussion of its basics, the industries needed to buy Professional Indemnity Insurance (PI) and the main aspects affecting its pricing.

What is Professional Indemnity Insurance?Professional Indemnity Insurance is designed to protect insured businesses from claims arising from their mistakes, errors or omissions of their professional services. Whether if they are lawyers, medical practitioners, consultants or engineers, this type of insurance can provide them with the necessary protections to ensure that they would not face huge financial losses even if mistakes appeared in the process of service provision. This type of insurance has a main purpose to provide these businesses with financial protection against loss due to litigation.

Through bearing the cost of litigation, Professional Indemnity Insurance helps businesses to deal with clients’ claims, reduce financial burden and ensure their normal operation would not be affected. In certain industries and regions, PI Insurance is not only a voluntary protection for businesses but also a part of the mandatory requirements within the law or in a contract.

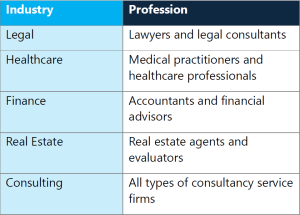

Which industry needs to buy Professional Indemnity Insurance?Applicable industries

Traditional professional industries like lawyers, accountants, auditors, architects and designers, surveyors, property assessors and so on need to purchase this type of insurance. There are respective industry-specific PI insurance products available in the market. Emerging industries like Information Technology, Project Management, Property Management, inspection agencies, translation and media companies, manufacturers’ instructors for installation and debugging should consider purchasing PI insurance.

Professional Indemnity Insurance can provide a business with cover to reduce its potential financial loss. It indemnifies the insured company from its responsible liability for damages in case of third-party claims caused by negligence or fault in the services, advice or solutions, etc. it provides in its normal operations.

More importantly, it can be necessary to go through legal proceedings as the loss amount being more significant. This legal cost induced could cause no small financial loss that the company could ignore.

Factors affecting the premium of PIThe premium rate for Professional Indemnity Insurance is not fixed. Normally it is based on the specific situation of a policy which is being negotiated individually. In general, the factors affecting the premium are as follows:

- The applicant’s professional risk profile

- The applicant’s history and management’ experience

- The applicant’s financial status at present and the revenue forecast for the next year

- The applicant’s risk management profile

- The applicant’s sources of income. If those sources are within China, the premium will be lower. If those sources involve overseas companies and include the USA and Canada, the premium will be the highest for these two countries due to their different legal systems.

- The applicant’s claim history for the last few years

- The required maximum limit of liability

In summary, Professional Indemnity Insurance is also an important consideration for businesses. It not only can become an effective mitigation tool for their risks, but also can help gain more opportunities for collaboration as many firms have been requested by their overseas clients to provide PI policies as a necessity for their cooperations.

If your business’ work involves professional services that are missing in the PI cover at present, please contact our team at any time for insurance purchasing advice.

To learn more about Professional Indemnity Insurance, contact our Professional and Executive Risk.